Thoughts on Restaurants and PPP Forgiveness Provisions

Many business owners, myself included, are experiencing momentary relief as they “magically” received the equivalent of 2.5 months of payroll in their companies’ bank accounts these past few days. A few weeks ago I felt little hope that anything viable lay ahead, and even created a video entitled “Last Call” letting our customers and neighbors know we would soon be shutting our restaurants (spoiler alert: their support and generosity kept us going for weeks). That was before we had any details of the CARES act and all that it entails. And while the process of applying for the PPP funds under the CARES act certainly felt chaotic to most, and for the bankers burning the midnight oil, it has been, relative to most alternative processes for raising capital, it was a relative cinch and almost mindless.

That’s where the simplicity ends.

Had these funds come either in the form of simple grants or straightforward loans – one or the other – what follows wouldn’t be necessary. However, the structure of the PPP Loan is a hybrid of the two, adding complexity that has some accountants moving into overtime and borrowers scratching their heads as to how best to proceed. And the decisions made in the days and weeks that follow could impact a business for years, if not be the difference between survival and failure.

The day the funds are received (in the case of two of the entities I control, April 14 and April 16), an 8-week clock begins to tick. As things look currently, everything stipulated in the PPP guidelines must take place in this 8-week period to be eligible for forgiveness of up to 100% of the PPP funds received. Should certain thresholds not be attained, one of the most important being that 75% of the funds must go toward payroll, the amount forgiven begins to decrease and the remaining balance officially becomes a (very short) 2-year loan (at an admittedly attractive 1% interest rate).

One likely asks…

What could be complicated about having tens or hundreds of thousands of dollars to spend, all of which can be forgiven if spent “correctly”?

Here is a short list of conflicts – all well-intentioned constraints, no doubt – that come to mind immediately. I also offer a couple of (perhaps overly simplistic) solutions that would solve inevitable challenges for thousands of business owners and their employees under the current structure:

CONFLICTS:

1) STATE STAY-AT-HOME ORDERS VS. 8-WEEK PPP EXPENDITURE PERIOD

Most states have issued stay-at-home orders for all but essential workers to “flatten the curve” and keep people safe. As such, with almost no customers showing up, most restaurants across the country are either closed or significantly down (50-85%) in traffic.

As long as officials are saying “stay-at-home”, restaurants in areas impacted by those orders should not be considered “essential” businesses, and therefore should not have any pressure to open and possibly ask employees to put themselves in harm’s way until the orders are lifted.

The PPP funds have a clear 8-week time constraint that has already started for many of us. In bringing laid off or furloughed employees back to the frontline to work – mainly to expend those PPP funds for purposes of forgiveness – when no customers are present, businesses will unnecessarily be asking employees to leave the safety of their homes to come into work where no essential service is provided.

2) EXPANDED UNEMPLOYMENT BENEFITS ($600/WK EXTRA) VS. RETURNING TO WORK

Many laid off or furloughed employees in the low-income brackets have not only had the rare chance to stay out of the direct line of fire of this terrible virus, but they’ve received more income to do so thanks to the federal $600/week unemployment benefit than they did even while working full-time. On a personal level, I applaud this first-in-a-lifetime benefit to those who are so often left behind. Think about it… it’s an extra $15/hour for a 40-hour work week for which they don’t have to actually work. Some of us call that a paid sabbatical and feel we’ve earned it when we take it. Believe me… so do my employees and millions of others deserve it.

The conflict in asking them to return so quickly – again for the primary purpose of their employers making proper use of the PPP funds for forgiveness purposes – is not lost on them or business owners. The business needs, until customers feel safe returning, would not call for most employees to be rehired. In addition, since the employees have this short moment in history where they are paid the same as at work and usually more to stay safely at home, to help flatten the curve, it seems unreasonable to ask them to exchange higher and safer stay-at-home pay for lower working pay and greater exposure to sickness.

3) 75% PAYROLL THRESHOLD FOR FORGIVENESS VS. LONG-TERM SURVIVAL OF BUSINESSESS

Most street businesses (restaurants and retail, specifically) already owe one full month’s rent for April and will soon owe for May, too. And while June is in question, it’s very unlikely that most tenants will be able to pay rent in full. Most businesses, mine included, won’t be able to get back to full payroll until May 4 (update: May 15 in Massachusetts per Governor Baker’s announcement on 4/16) at the very earliest, and likely much longer. The only option to remain within the guidelines of forgiveness would be to begin expending the monies to pay people while they are at home since there are no customers to serve. Per 2) above, this provides them with less compensation than they currently receive through the expanded unemployment benefits, and ultimately leaves businesses unable to reopen in “good” standing, if even solvent, in a month or two from now. The 75% threshold simply shifts a great deal of the “unemployment” pay burden from the government to the business, delaying by only a few weeks the inevitable failure of thousands of small/medium businesses.

4) PAYMENT TO SUPPLIERS NOT INCLUDED IN PERMISSIBLE PPP USES

Many of our suppliers, especially the smaller ones, are struggling as badly as their restaurant customers. Most of our landlords are large, extremely successful, corporations with healthy balance sheets. While including rent in the PPP uses is critical because landlords have so much leverage, the suppliers need to be paid too. I don’t know if its permissible to do so and we simply won’t see those funds forgiven, or if its forbidden altogether with possible legal recourse. But I hope to be able to spend some of our PPP loans, as do others, to support struggling vendor partners and suppliers.

TWO SUGGESTED SOLUTIONS:

1) ADJUST 8-WEEK CLOCK START DATE

Adjust the 8-week clock start date to 14 days after the lifting of stay-at-home orders by the Governor of any given State (For Massachusetts, if the date sticks to May 15, for example, the start-date for our 8-week test period would be May 29). This gives businesses a chance to re-staff in an orderly, safe manner, and also meet the first payroll when sales will still be likely severely depressed in those early weeks.

2) INCLUDE RENTS & OTHER OCCUPANCY COSTS IN 75% THRESHOLD FOR USE OF PPP FUNDS

Until landlords have known solutions themselves, which often require lenders to take action (which I’m warned is slow even in drastic times like these), small businesses are legally on the hook for crippling amounts of money that could take away any benefits of having paid their employees through the PPP program. An alternative could be to include occupancy costs and payroll as part of a larger percentage of the use of PPP funds that are forgivable… say 85-90%. If business owners can’t pay landlords and mortgages, the jobs and/or income they provide in the next 8 weeks won’t go much further.

3) INCREASE LOAN DURATION FROM 2 to 4 YEARS

Should none of the other suggestions take place, simply extending the maturity dates of the loans will allow many business owners to make the decision to expend funds as they see fit AND have room to breathe and pay back the loan as business recovers. The current duration of two years puts unnecessary stress to focus on forgiveness, when four years, as an example, would allow business owners to consider options more thoughtfully.

4) INCLUDE SUPPLIERS IN USE OF PPP FUNDS

Again, I’m not 100% sure on this point, but if they aren’t permitted as seems to be the case, perhaps leniency here could help those of us with the loans help others who have similar challenges (and may or may not have PPP funds themselves).

—-

I want to emphasize that I don’t mean to sound ungrateful. Before the details of the PPP loans were announced, I had largely given up hope that my company could re-open all of our New England restaurants once we reached the other side of the curve. The PPP loans were done extremely quickly, which many of us applaud. Better to move swiftly and leave a few things unanswered and imperfect than take the extra time (in this instance, especially) to get it perfect (never possible) which would have caused business owners to take more dramatic, fear-based actions in ways that could have been hurtful and possibly irreversible. I’ve said to a few people… had someone approached me and offered me a simple $300,000 2-year loan at 1% interest to help get through this crisis, which is a likely outcome of my own circumstances, I would have had the pen out to sign with zero hesitation. (The other irony I’ve shared is that when the idea of forgiveness of these attractive 1% loans coupled with paying unemployed people $15/hour for 40 hours of non-work was put into law, Bernie dropped out of the Presidential race when the little voice in his head said “my work here is done”).

In closing, I’m most grateful for the Expanded Employment Benefits that have allowed people in low-wage jobs to leave their positions with a level of security and freedom to take care of families and themselves in ways many never thought possible. A well-deserved break, to be sure. Regardless of what might have happened to my businesses, this “paid sabbatical” for millions of low-wage employees alone would have been a welcome change in how we in the US treat those who are too often left behind. Sure, it will make it harder for employers trying to convince them to return to work for a while, but most of us in the employer category are pretty lucky compared to those we employ. I’m not going to be selling when it comes time to rehiring.

Thank you to anyone reading this. I would love to hear from you. Keep it clean, civil, and respectful… we are all looking for answers, and I don’t claim to have any of them. But I am happy to help arrive at them in whatever way possible.

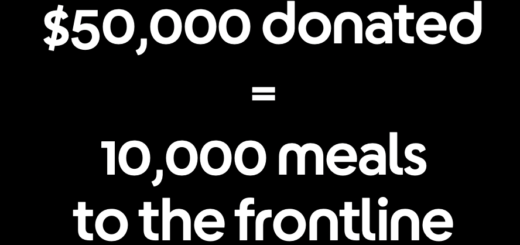

#FeedTheFrontline Fundraiser: GoFundMe Campaign

Brilliant, John, we wish that our legislators in crafting the relief efforts would have been as visionary as you are. I hope that all the adjustments and considerations you raise may be put into play.

Your comments are well-founded, John. I’d endorse your suggestions, and would also wish there had been a clearer boundary providing for the funds to be directed to small businesses, and a clearer format easing the process for lenders who were initially reluctant given a lack of clear direction. I’m not averse to larger companies getting support, but too many of them, with ready access to legal and administrative support, found ways to benefit from this program, restricting the availability of funds to the businesses it was originally intended to help.