Twitter Rant on Landlords (and Banks)

The other day I had a so-called Twitter rant. My direct complaint is that the higher you go up on the food chain, the less people at those levels feel compelled to voluntarily participate in the pain that is mostly hitting those on the lower rungs.

The closer you are to labor, the workforce, businesses that face Main Street, the worse off you are. The closer you are to capital, finance, Wall Street, the better off you are. I’m sure there are exceptions, but knowing countless people very well at both extremes and every where in between, I don’t believe my assumptions are too far off.

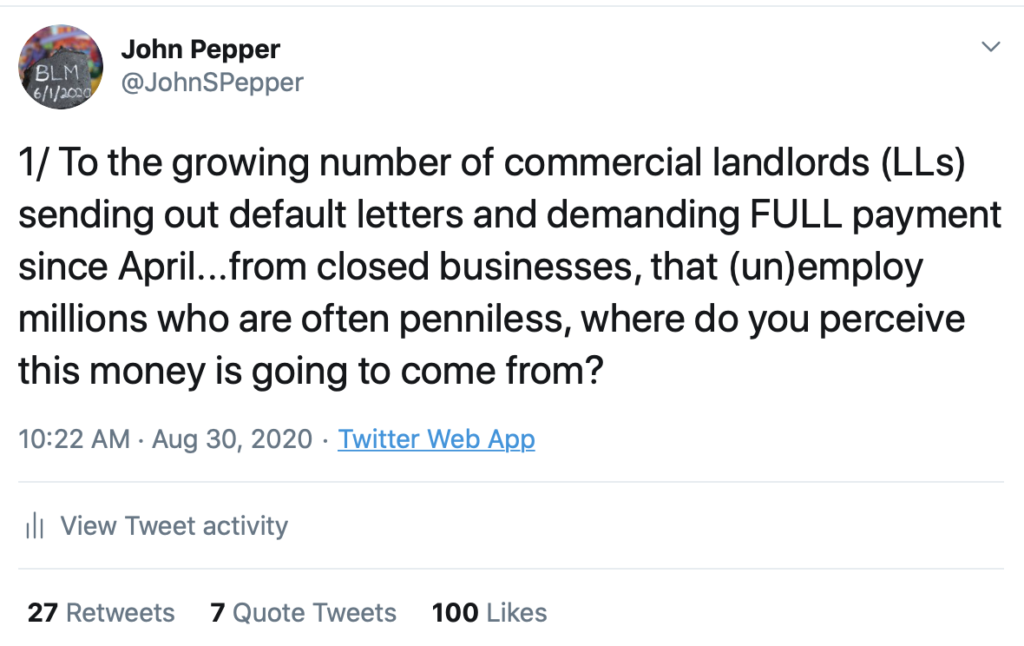

Here’s part 1/ of the 11 part rant, in case you missed it – click through for the whole thing:

2/ I understand that you have “fully enforceable leases”, that you “would be foolish not to protect your interests”, and that you “have to report to shareholders every quarter”. However, not recognizing this pandemic and your critical role in it, as someone else said, is inhuman

3/ Most Main Street (and side street) businesses are barely hanging on. The ones that are thriving are to be applauded but they are not the norm (and they are asking for breaks too, and getting them! That’s what we can call the leverage of success 😉

4/ “In a moment where landlords could generate enormous goodwill, especially with smaller companies, I believe they are doing the opposite…. they are telling their customer (the tenant) who literally cannot use the physical space they are renting, “sorry-not my problem” @bfeld

5/ One solution – move tenants to rent as % of sales thru duration of #COVID19. If LLs are stuck in financing structures that monetized the real estate in full (big payout to few people) and take a hit, that’s the club your tenants and employees are in (less the payout!) Welcome!

6/ Were it not for the very real threat of LLs decimating our businesses (by taking legal action) and, when possible, extracting from owners personally, owners/ founders/managers could probably focus more on safety and new business strategies to survive than is possible now

7/ As a once solid tenant of many LLs for many, many years (who always got paid – even when it all went bad – always), the goodwill associated with that has bought us very little as the “generosity” of rent deferment has switched to “pay us now and pay us all of it” or else

8/ The other day, I told someone that I felt like I was being bullied in the schoolyard by a few of these landlords. They have the power and sadly too often the personalities to bully successfully. If I feel bullied and threatened, and I’m a white, privileged male…

9/..I can’t imagine what it feels like for those with < advantages whose livelihoods/families are truly on the line. I may lose my business of 23y and yes, the world will go on. But the L.T. ramifications of bullying on hard working adults by those in power can’t be quantified.

10/ I hope that @boloco and others can find pathways to survive the pandemic and the suffocating debts that are accruing, but landlord bullying has no place. It never did. I read this article this morning with interest which inspired this post… (click fist image)

11/ The article doesn’t directly cite landlords or even business in bullying. But it’s not hard to tie them together, especially concepts like “exploitation, entitlement and empathy impairment” paired w anonymity (would they do it if their names hit the @BostonGlobe? Maybe/not?)

End/ When you see a Main Street biz closed or struggling, sometimes its the result of weak branding, mgmnt, or execution. But these days, its often a lot more than that. Landlords have a big opportunity to change the landscape of Main St. for the better. I hope they take it.

A few comments from the crowd that gathered made me feel compelled to add a little more color than I was able to do on Twitter.

Comment: These landlords have mortgages too, what do you expect happens when those are unpaid.

Me: If landlords don’t pay mortgages, the same thing that happens to restaurants when they don’t pay rent happens to landlords – which is the same as when low wage workers can’t pay their bills. Things start unraveling, a domino effect, which is what we are starting to see. Banks also need to play human here. But many landlords do have the means to help… they monetized early on. Cash came in up front and if they pocketed it all, they may need to look in the gold-plated mirror and realize they have a big role. Especially the large landlords. Just because they can push for full indemnity because they had the right lawyers and leverage to write leases that favor them doesn’t mean they should.

Comment: Is it possible that many of them (LLs) literally can’t do, legally, what you’re suggesting? If a landlord has multiple lenders with covenants, it may not be up to the owner/property manager’s generosity/flexibility. Large lenders tend not to be nimble / entrepreneurial… & especially when dealing w multiple lenders, sometimes easier said than done. if it’s a local property owner with a primary mortgage with a MA bank, that’s different than a publicly traded REIT that may have securitized loans where it isn’t even clear how to get lender consent.

Me: To be fair, commercial landlords are definitely in their own challenging position, and not all landlords are experiencing the same levels of crisis.

It’s very possible they can’t do all that I suggest without repercussions, but part of the point is that like the rest of us they may need to dig into their own pockets to make things work. The lending structure enriched many of them before property really should have been monetized.

Small landlords who rely on monthly rent to pay the mortgage and sustain their families are very similar to small businesses. That said, I don’t have a single landlord of our small chain of restaurants who isn’t comfortably in the “capital” category I mentioned above. Only 2 of the 8 are what I would call family affairs, and with both I have not just business ties but varying levels of personal relations (neighbors, friends, acquaintances). I am 100% certain that one of them would do whatever he could to help, as necessary, and thankfully in that case no help is necessary. The other family owned property simply stated to me at the beginning of the crisis “I’m not a bank” and that’s all I’ve heard. We have paid bits and pieces of our rents and while I know the family is “fine”, I wish the dialogue were more representative of the time I’ve known them and one that didn’t feel like somehow we are going to end up on opposite sides of a double-edged legal sword. They have bills to pay and based on what I’ve seen, they are being paid with or without our small Boloco location operating. I’m grateful to know that the pain Boloco currently feels with closed restaurants isn’t inflicting real pain on families and children.

The other 6 commercial landlords of Boloco are all large organizations, corporations or REITs and these I have some concerns about. They are sophisticated in every aspect of the business – building, buying, selling, leasing, legal, upkeep, services – and when things go wrong they generally make sure you know who is in charge. They have the power, and they will use it as need be. In the past, these conversations have never gone well – very little human consideration enters the equation. Hundreds of thousands of dollars and more can be lost trying to exit poorly performing retail and restaurant locations as penalties for early departure, and in the worst cases I’ve seen landlords take that money, raise rent further to the next tenant, and essentially increase their winnings based on other’s failure. Yes, in some cases they are better off when tenants fail than they are when the tenants succeed. Talk about backwards incentives.

I’ve rambled long enough. I’ll see if I can make progress on our own real estate dealings and report back if I learn anything.

Day 2 ✅

Recent Comments