“When to Jump” – Panel Prep 9/7/18

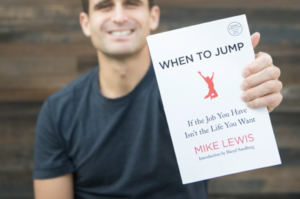

This is a post in which I hope to find a few nuggets to present later today on a panel called “When to Jump” at the Dartmouth Entrepreneur’s Forum here in SF. Love being here… energy is contagious. The book “When to Jump” was written by Mike Lewis D’11 and he is apparently providing 150 copies for people who show up. He was also an AD.

This is a post in which I hope to find a few nuggets to present later today on a panel called “When to Jump” at the Dartmouth Entrepreneur’s Forum here in SF. Love being here… energy is contagious. The book “When to Jump” was written by Mike Lewis D’11 and he is apparently providing 150 copies for people who show up. He was also an AD.

About me. Want to change this up a bit. Less Boloco, more future focused.

First and foremost, I’m a dad and husband. The older I get, the more I cherish this than I did 15 or even 10 years ago.

I’m also one of the founders of Boloco and with exception of a brief hiatus from 2013-2015 when I stepped away, I was the CEO from 1997 when I was a 2ndyear at Tuck until earlier this summer. So better part of last 2 decades.

I also was a founder of a 75-location family of restaurants called B.Good, which was really my first angel investment which I exited successfully 12 years later. Being part of the B.Good journey taught me how much better I can be at suggesting people try certain strategies than trying to do those same things myself. It also taught me that I love supporting passionate entrepreneurs with a deep conviction about why they believe they need to go into business for themselves.

Since then, I’ve invested in about 15 start-ups both in consumer tech, tech-facing restaurants and retail, as well as a couple of restaurant companies. 3 of those were started by Dartmouth or Tuck alums, marked with a little green “D” below.

1998 (Can’t Remember Name) (CVG) – Fail

2002 Cazuelas (SF) – Fail

2003 B.Good (BOS) – 9x return

2004 Moxie (LONDON) – Fail

2006 Farmer’s Diner (VT) – Fail

2011 Kigo Kitchen (SEA) (D) – Ongoing

2013 Clover (BOS) – Ongoing

2014 Dunwello (BOS) – Fail

2014 Spindrift – Ongoing, Initial Capital Returned in Series B

2016 Dos Toros (NYC) – Ongoing

2016 Botanica Seattle (D) – Ongoing

2017 Higher Me (Toronto) – Ongoing

2018 Path Spot (NYC) – Ongoing

2018 One Mighty Mill (BOS) – Start-Up

2018 College Pulse (D)- Ongoing

So far B.Good returned nearly 10x my investment over a 12 year period, 5 of the early investments failed, and I have 9 still plugging away, a few of which look really promising and are regardless exciting and fun to be a part of.

Finally, and super-related to this idea of When to Jump, I’ve been working on a start-up called Worthee for the past year – the goal is to shift my focus from using burritos to using technology to transform the lives and futures of hourly workers. It’s a huge problem to solve, anyone here thinking they know a company that is on the way to solving it is likely wrong, and I am incredibly passionate about this work.

Finally, and super-related to this idea of When to Jump, I’ve been working on a start-up called Worthee for the past year – the goal is to shift my focus from using burritos to using technology to transform the lives and futures of hourly workers. It’s a huge problem to solve, anyone here thinking they know a company that is on the way to solving it is likely wrong, and I am incredibly passionate about this work.

Jumping… first, for me, jumping is all about the recognition of an irrational passion for something that matters. It doesn’t have to be huge, and it doesn’t have to be on a straight up and to the right growth trajectory – it just has to be sustainable in its ability to do good for those it touches for me to feel the jump is worth the risk. When I first jumped back in my 20’s, these weren’t conscious criteria, only after looking back can I identify the key ingredients necessary to make the leap.

While I don’t recommend people jump awayf rom situations where they are miserable, I do recommend they leverage their misery to find a good place to move next. I did that a few times. I think of Smith Barney in NYC during the summer of ’96 – that was brutal. Working at 5/3 Bank in 1991-1992 right out of college most definitely showed me I just couldn’t show up at a 9-5 job in a big building with a suit on… unless of course it was for something that mattered. Chasing delinquent student loans didn’t cut it for me.

When you really make a jump, you’ll usually know it. You’ll feel it in every bone of your body. In my case, I was shivering, quite literally when I jumped in 1998 – leaving quite suddenly, for the final time, the financial world at Montgomery Securities to get back to the restaurant business I had started with Adam and Gregg. I was at a truck rest stop in Nebraska, sleeping in a sleeping bag on top of my Chevy Tahoe – Uhaul in tow – staring straight up at the stars, and could physically feel the shift in my life. The fork in the road, from finance to burritos, was very real. I knew I was making a life decision at the age of 27.

Jumping isn’t just reserved for moving from “normal” life to something you deeply believe in. It happens regularly along the entrepreneurial journey, and it never really gets easy. Especially when you start building a little success and you think you have things to lose, the tendency to pause is strong. I think of the time in 2002 when at Boloco we decided to change the entire business model… some said we were throwing away any hope of a real business… by moving our internal minimum wage to $8 when minimum wage in MA was 5.75 and Starbucks, our benchmark, was starting people at $6.50. Without any data, other than a perception that In-N-Out burger did well despite paying its people better than anyone else, we leapt in the spirit of doing the right thing. Moments like that trained our “jump muscles”, let’s call them… when the time came to make decisions that carried risk but pushed us into the flightpath of our mission, we were far better prepared to actually execute.

We also made some small jumps that of course seemed big at the time… connecting all restaurants to high speed internet before there were any compelling reasons to do so. The benefits of doing that showed up in a matter of weeks as the pre-cloud tools began to emerge quickly. Building an online ordering website in 2004, and then an app in 2008, before anyone else was doing it, when mobile wasn’t what we take for granted today. While some of the jumps yielded no results, or even negative results, we learned a lot from them. With a few exceptions (switching from our old Boloco loyalty cards via Paytronix to the digital loyalty program offered through Level Up, as well as switching from Olo to Zuppler online ordering, being the two biggest jump snafus that continue to hurt us to this day), we’ve typically not hurt our business when we leapt forward into unproven territory.

Years later, in 2015 when I was considering buying back Boloco from our private equity investors – and honestly the company was in shambles, I called on many people for advice. Ron Shaich, founder and long-time CEO of Panera told me around that time…

“John, you should not do it. Think of hopping into your car and heading up on a windy mountain road in a snowstorm. Maybe you think you have the skills. But if you do this, you’re strapping your wife and kids into the car and putting them at risk too. You can’t do that to them.”

I took the advice, and somehow convinced myself that through further negotiation and deal restructuring, I had stopped the analogous car and “taken my kids out of the car” and put them in a little shelter on the side of the road. And then up we went… in this case, my wife insisted she come too, and the turnaround that we and the team orchestrated at Boloco between 2015-2017 was about as big a jump as I’ve taken, with immense personal risk and not knowing whether the 5thcompartment of our Titanic had actually been compromised meaning certain failure.

Today I’m working on what feels like the biggest jump yet. If I didn’t believe so deeply that Worthee needs to exist, I would hang my hat on being a dad, a husband, and continuing to run a business that does well enough to carry me forward and feel like our work makes a difference in the areas we impact. I am also an elected official in my town… chairman of the Norwich VT Selectboard (term for Town/City Council in small New England towns)… I try to give everything I have to that position, and it takes a lot of time. A jump to Worthee as a full-time endeavor means I won’t be running for reelection in a year or two.

As far as this idea in the book “Not looking back”… I do look back, but I generally don’t regret. When I was suffering, or struggling, what sometimes felt like a last gasp did not translate into cutting costs to the bone, but instead to double down on what we felt was most important, on our “why are we in business”, on our mission and purpose.

A couple of other questions they want me to think about…

- Where, and how, did you fail, in making your jump? How did you recover?

I failed multiple times at what I’ll call the “reverse jump”. Going corporate. I couldn’t deal with structure, hierarchy, policies that made no sense, etc. I always fell back into entrepreneurship.

- No jump is made alone – who were the most critical teammates, mentors, and others in your corner as you took the leap?

I’ve always overcommunicated with my wife Maggie and our kids on what was happening at work. I wasn’t always sure it was good to expose them to the risks, but it seems to have helped them become accustomed to living in some level of uncertainty.

My team at Boloco has been instrumental. And nowadays it’s a very, very tenured team. Average manager just over 11 years with us, average team member just over 4. I try to be extremely transparent with them so that they are best prepared to assist and contribute every step of the way.

But strangely the naysayers play a critical role in these decisions. While perhaps delusional, hearing some of the arguments as to why you should not do something provides further motivation, at least in my case, to actually do it. And yet with the naysayers come some great cautionary tales that inform strategy and direction once up and running.

- What role, if any, did the Dartmouth community play in your jump journey?

In the 90’s, jumping meant you were hurting the stats of the career services office… so I didn’t feel much support for a few years. Steve Lubrano who ran Tuck Career Services in the mid-90’s gave me “permission” while I spoke to him from a pay phone in the Transamerica Building in SF to leave Montgomery, get the Uhaul, and move back to Boston to pursue Boloco. I had been worried about Tuck’s recruitment reputation if I resigned… he simply said “GO!”

Today, things are completely different. Dartmouth and my relationships around the world matter a lot, and I always feel like I have friends to turn to for advice in nearly every aspect of business.

- What surprises you the most from your jump experience?

How traumatizing it is, and yet how much hope I still have for good things.

- What would you tell other Dartmouth alums about what you wish you knew about jumping, before you went for it?

Get a partner or partners you love to work with… who you trust, where you each think the other is smarter. Set your ground rules as early as possible. Learn from your mistakes, from your squabbles with other people, write the lessons down, refer back to them. Turn them into Principles, even, as Ray Dalio from Bridgewater would forcefully suggest.

All for now.

Can’t seem to reply on your online ordering post — but love the blog ! It’s inspiring and so well written.